Blockchain Introduction

(Usage hints for this presentation)

VM Neuland im Internet 2021

Dr. Jens Lechtenbörger (License Information)

Agenda

1 Introduction

1.1 Last Week Tonight with John Oliver

March 2018, on crypto currencies: “Everything you don’t understand about money combined with everything you don’t understand about computers”

- (My addition: And everything you don’t understand about game theory)

1.2 Bitcoin’s Academic Pedigree

- Survey

[NC17] by Narayanan and Clark

- Nearly all technical components of bitcoin originated in academic literature (1980s, 1990s)

- Nakamoto stood on shoulders of giants

- Focus on “Nakamoto’s true leap of insight—the specific, complex way in which the underlying components are put together”

- Details far beyond this presentation!

1.3 Omissions

- Focus here on blockchains à la Bitcoin, i.e., public/permissionless with proof of work consensus

- Beyond that, see survey [DLZ+17]

- Ethereum, Parity, Hyperledger Fabric, private blockchains, proof of stake, PBFT, non-byzantine consensus variants, smart contracts, and more.

- “The results show that current blockchains’ performance is limited, far below what a state-of-the-art database system can offer.”

2 Terminology

2.1 Crypto Recap

- “Blockchain” uses standard cryptographic primitives

- Collision-resistant cryptographic hash function

- Map any data to “unique” hash value of fixed length, e.g., 256

bits in hexadecimal

0x420815abc...- Digital fingerprint, cryptographic digest

- Finding collisions must be computationally infeasible

- Map any data to “unique” hash value of fixed length, e.g., 256

bits in hexadecimal

- Digital signatures (asymmetric cryptography)

- Participants own key pairs: private and public key

- Alice creates signature on document with her private key

- Bob uses her public key to verify signature

- Proof that document (a) came from Alice (authentication, non-repudiation) and (b) unchanged by anybody else (integrity)

- Alice creates signature on document with her private key

- Participants own key pairs: private and public key

2.1.1 Key Pairs in Bitcoin

“Account” (part of wallet) tightly coupled with key pair

- Public key used like account number

- Transfer of bitcoins “to” public key

- Private key used to authenticate “transactions”

- Alice signs transfer of bitcoins from her account to Bob’s with her associated private key

- Everybody can verify that transfer with Alice’s public key

- (Whoever has access to the private key can transfer coins)

- (Remember Mt. Gox? 650,000 bitcoins “lost”)

- Public key used like account number

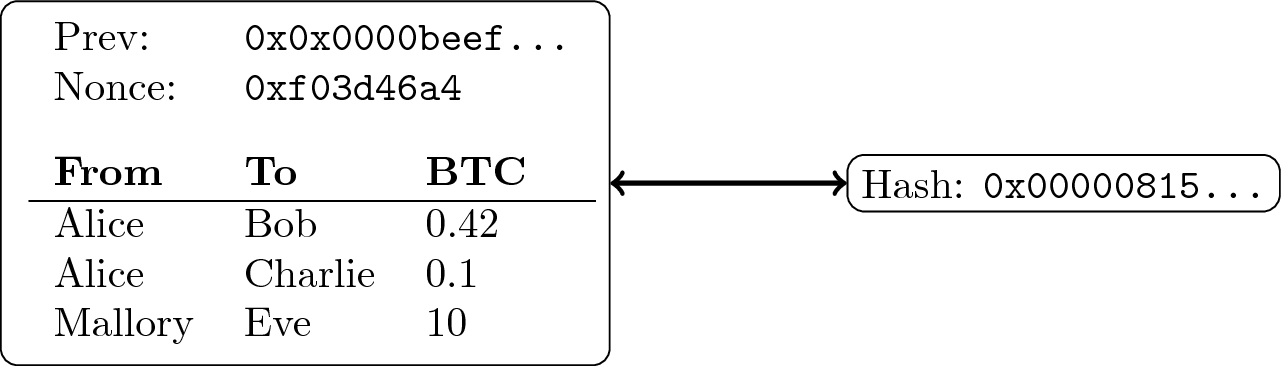

2.1.2 Hash Pointers

- If collision resistance is given, we can identify any data with

its hash value

- (If data changes, the hash value changes)

- E.g., data represents a block of transactions

- That block is stored at some address

- With hash pointers, we not only record the address but also the block’s hash value

When retrieving the block, verify that it is unchanged

![Block of transactions with hash pointer]()

“Block of transactions with hash pointer” by Jens Lechtenbörger under CC BY-SA 4.0; from GitLab

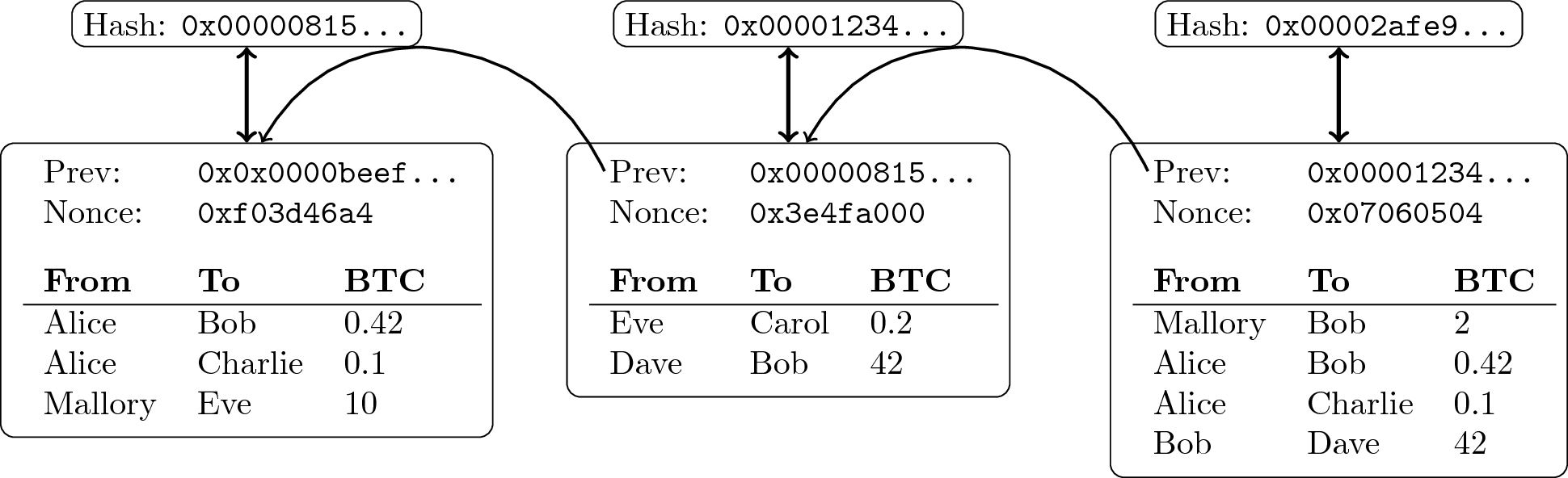

2.1.3 Chaining Data

- Append-only logs can be constructed by chaining blocks with hash

pointers

- Typically, blocks organized as Merkle trees

- Leaf nodes are transactions, internal nodes are hash pointers

- Hash of tree’s root serves as digest for block

- Inclusion proofs (of transactions) possible with little data

- Typically, blocks organized as Merkle trees

“Block chain of transactions” by Jens Lechtenbörger under CC BY-SA 4.0; from GitLab

2.2 Bitcoin Basics

2.2.1 Bitcoin Origin

Announcement of bitcoin as “P2P e-cash” on Cryptography Mailing List on 2008-10-31 by Satoshi Nakamoto

- Link to famous paper [Nak08]

- [Nak08] does neither mention “blockchain” nor “block chain” (but “chain” and “block”)

- Source code for bitcoin announced later on 2009-01-08

2.2.2 Bitcoin Goals

- Decentralized currency

- No central authority; neither to issue coins nor to create accounts nor to monitor transactions

- Peer-to-peer network of miners solves cryptographic puzzle to extend blockchain as “ledger of transactions”

- Proof of work

- Blockchain = data structure ≠ database

- (Database system = DBMS + managed DBs)

- Replicated among miners

2.2.3 Bitcoin Security

- Ownership of coins with digital signatures, no double-spending

- Do not promise “same coin” to multiple parties

- Miners check whether amount of proposed transaction unspent in current blockchain

- Consensus

- Blockchain is probabilistically append-only (revisited below)

- No way to revoke/undo transactions

- Do not promise “same coin” to multiple parties

2.2.4 Bitcoin Transactions

- Transfer of coins from one account to another

- Blocks in blockchain contain multiple transactions

- When new block is mined, first transaction allows miner to transfer block reward to own account

- This creates new coins

- Amount of new coins per blocked halved about every 4 years (started at 50; 6.25 since May 2020)

- Transactions can have multiple inputs and output (graphics here are simplified to show just one input and one output)

- Inputs refer to (hashes of) transactions

- Outputs subsume fees (to miner) and change (to sender)

3 The Blockchain?

3.1 The Block Chain

- Comments in the source code of bitcoin mention “block chain”.

E.g.,

main.h#l1013// // The block chain is a tree shaped structure starting with the // genesis block at the root, with each block potentially having multiple // candidates to be the next block. pprev and pnext link a path through the // main/longest chain. A blockindex may have multiple pprev pointing back // to it, but pnext will only point forward to the longest branch, or will // be null if the block is not part of the longest chain. // class CBlockIndex

- Also for

CBlock,CWalletTx,CMerkleTx

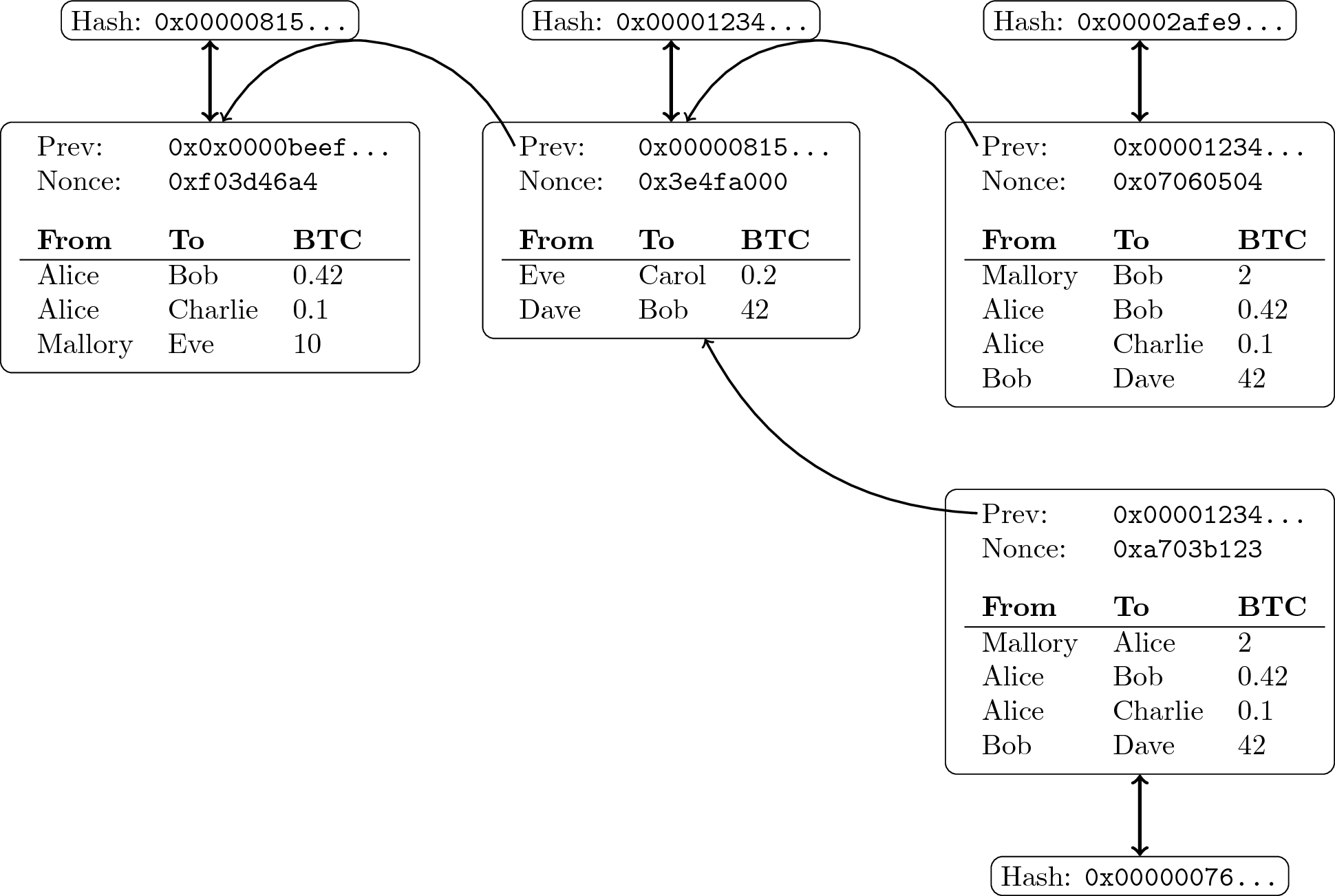

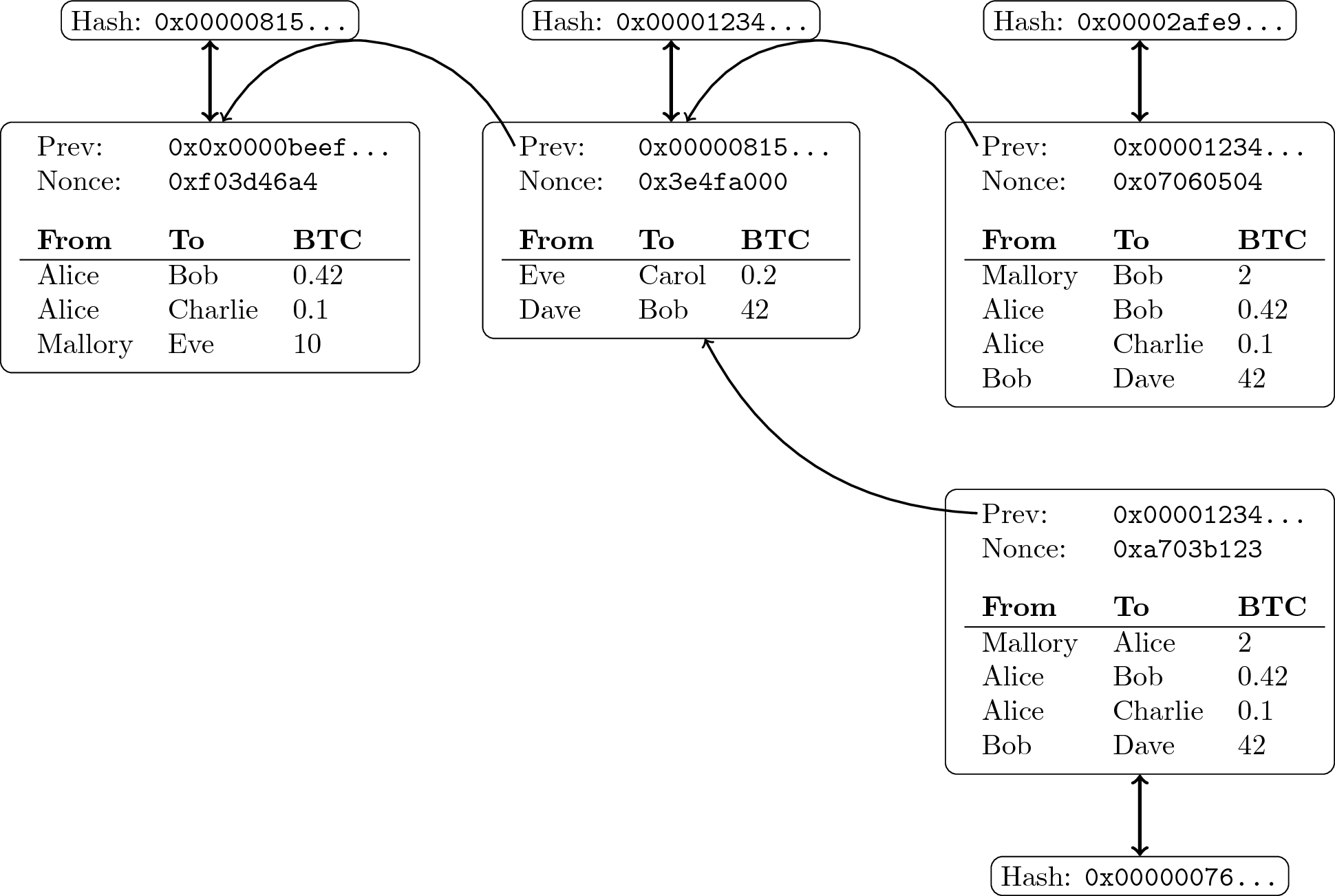

3.1.1 Trees of Blocks

- The “chain” is expected to fork into branches

- A tree structure emerges

- The longest (actually, the most work-intensive) chain of that tree records “the truth” in Bitcoin

“Block tree of transactions” by Jens Lechtenbörger under CC BY-SA 4.0; from GitLab

3.2 The “Blockchain” in Bitcoin

- Tree-based data structure as just explained

- No database! (Thus, no distributed database either!)

- Replicated/copied among P2P network of miners

- Extended asynchronously

- After solving a cryptographic puzzle: Proof of work

- Different miners may work on different versions (forks, branches, orphans)

- Extended asynchronously

- Does each miner maintain “a blockchain”?

- Comment above suggests so

- Is the entire set of chains of blocks “the blockchain” (of bitcoin)?

4 Blockchain Characteristics

4.1 Distributed Ledger?

- What exactly is a “ledger”?

- Why invent a new term for a persistent, tamper-proof data structure?

- “Distributed” does not carry much defining value in blockchain contexts.

- E.g., Google’s infrastructure using Paxos [Lam98] is distributed, yet controlled centrally.

4.2 Decentralized, Public, Open, Replicated?

- No central control, no intermediaries/middlemen

- Anyone can take part

- Obtain copy

- Take part in maintenance/consensus

4.2.1 Reflection

- Who does take part in Bitcoin’s blockchain?

- Initially, anybody’s PC was good enough

- [SZ18] Then GPUs,

now millions of dollars for ASICs

- Barrier-to-entry

- But also barrier-to-exit

- Special-purpose hardware not much use for anything else

- [GBE+18] Analysis of 10 months of data, starting July 2016

- Weekly mining power of top Bitcoin miner about 20%

- (Ethereum: 25%)

- Top 4 Bitcoin miners have more than 53% of mining power

- (Top 3 with 61% in Ethereum)

- 90% of mining power controlled by 16 Bitcoin miners

- (11 in Ethereum)

- Weekly mining power of top Bitcoin miner about 20%

4.3 Immutable, Append-Only?

- Frequently, blockchains are called immutable

- Clearly, they are append-only at best

- Bitcoin only offers probabilistic guarantees

- Forks/orphans violate append-only property

“Block tree of transactions” by Jens Lechtenbörger under CC BY-SA 4.0; from GitLab

4.4 Designed to Persist?

- Bitcoin defines rules for mining

- E.g., mine on longest chain, publish mined blocks, include all known transactions

- Block rewards, transaction fees as incentives

- Rational miners may behave differently

- [ES14]: Selfish mining

- Technique to collect block rewards beyond expected share corresponding to mining power

- [CKW+16]: Rules change when block rewards are negligible and

transaction fees dominate

- Selfish mining even more profitable

- New undercutting attacks

- “At worst, consensus will break down due to block withholding or increasingly aggressive undercutting.”

- [ES14]: Selfish mining

4.5 Justifiable?

- Proof-of-work (Bitcoin, Ethereum) is ecologically disastrous. I find its use unethical.

Digiconomist estimates yearly Bitcoin energy consumption of 112 TWh as of 2021-05-09 (up from 61 TWh as of 2018-04-20).

- 1135 KWh per transaction

- Do you know your household’s monthly energy usage?

- 1135 KWh per transaction

- With rising bitcoin prices, miners invest more in energy …

- 2021-05-12: Tesla stopped accepting Bitcoins for fossil fuel usage

5 Conclusions

5.1 Summary

- Blockchains aim for decentralized consensus over shared data

- No database per se, but building block

- The blockchain does not exist

- Advertised characteristics need to be analyzed carefully

- As usual, choice of terms is crucial

- Ask for meaning/definition

5.2 Constructive Thoughts

- Different (blockchain) scenarios come with different requirements

- Specify requirements first

- Select supporting technology afterwards

- E.g., a digital notary service based on linked timestamping (see [NC17]) or a distributed database with replication may be good enough

5.2.1 Effect of Signatures

- Digital signatures (even without blockchain) provide tamper-proof,

verifiable, decentralized evidence of statements/transactions.

- (If implemented properly based on strong crypto.)

- Transactions in Bitcoin cannot be revoked.

- Attempts of double-spending have no negative effect on attacker.

- Double-spending “resolved” at cost of randomly chosen victim.

- Although attacker’s account is publicly visible!

- Is that a requirement for your blockchain scenario as well?

- Attempts of double-spending have no negative effect on attacker.

5.2.2 Sample Application Scenarios

- Educational certificates on blockchains

- Different security needs than e-cash

- Must be revocable, e.g., to punish plagiarism

- Double-spending not an issue

- Little incentive for educational institutions to lie about previously issued certificates

- Different security needs than e-cash

- Other certifications, e.g., for real-estate may be embedded into

legal regulations

- Double spending leads attacker into jail

- Certificate Transparency

- Notary service without blockchain

- Append-only, open to public audits

Bibliography

- [CKW+16] Carlsten, Kalodner, Weinberg & Narayanan, On the Instability of Bitcoin Without the Block Reward, in: Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, 2016. https://doi.acm.org/10.1145/2976749.2978408

- [DLZ+17] Dinh, Liu, Zhang, Chen, Ooi & Wang, Untangling Blockchain: A Data Processing View of Blockchain Systems, IEEE Transactions on Knowledge and Data Engineering (accepted for publication) , (2017). https://doi.org/10.1109/TKDE.2017.2781227

- [ES14] Eyal & Sirer, Majority Is Not Enough: Bitcoin Mining Is Vulnerable, in: Financial Cryptography and Data Security, 2014.

- [GBE+18] Gencer, Basu, Eyal, Renesse & Sirer, Decentralization in Bitcoin and Ethereum Networks, CoRR abs/1801.03998, (2018). https://arxiv.org/abs/1801.03998

- [Lam98] Lamport, The Part-time Parliament, ACM Trans. Comput. Syst. 16(2), 133-169 (1998). https://doi.acm.org/10.1145/279227.279229

- [Nak08] Nakamoto, Bitcoin: A Peer-to-Peer Electronic Cash System, 2008. https://bitcoin.org/bitcoin.pdf

- [NC17] Narayanan & Clark, Bitcoin's Academic Pedigree, Commun. ACM 60(12), 36-45 (2017). https://doi.acm.org/10.1145/3132259

- [SZ18] Sompolinsky & Zohar, Bitcoin's underlying incentives, Commun. ACM 61(3), 46-53 (2018). https://doi.acm.org/10.1145/3152481

License Information

This document is part of a larger course. Source code and source files are available on GitLab under free licenses.

Except where otherwise noted, the work “Blockchain Introduction”, © 2018, 2021 Jens Lechtenbörger, is published under the Creative Commons license CC BY-SA 4.0.